SBI Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of SBI Life Insurance Company is 94.52% for the Financial Year 2019-20. SBI Life Insurance company is one of the biggest insurance company and having a old history in insurance of India.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| SBI Life | 5.14% | 22490 | NA | 95.03% | 94.52% |

- The claim settlement ratio of 94.52% is the indicator of the number of death claims settled by SBI Life Insurance against the total claims n/a reported for the FY 2019-20.

- Percentage claims have been rejected, resulting in Claim Repudiation of 5.14% for the FY 2019-20.

Table Content

Past 5 years CSR Trends for SBI Life Insurance Co.

Consistency to maintain a higher claim settlement ratio over the years is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the SBI Life Insurance Co. towards the settlement of death claims.

In term of percentage SBI stand in lower position but in term serving people numbers is enough than last year, but numbers doesn’t matter at all.

Let’s go through the past 5 years’ CSR trend of SBI Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 93.39% |

| 2016-17 | 96.69% |

| 2017-18 | 96.76% |

| 2018-19 | 95.03% |

| 2019-20 | 94.52% |

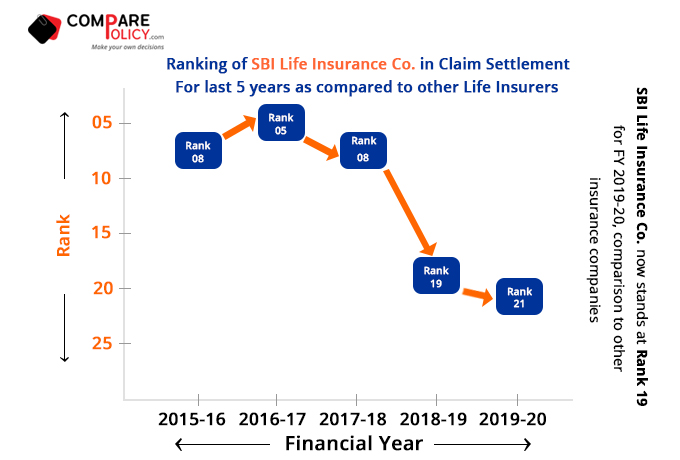

SBI Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where SBI Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by SBI Life Insurance Co. is the basis of the rank identified in the respective financial years.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

Hello Madam,

I have purchased SBI eshield policy on 05.08.2020. Premium due date is 5th of every month. My EMIs are deducted by mandatory deduction by ECH from my salary. My salary was not credited in my account till 05.10.2020 and due to insufficient balance policy premium for the month of 05.10.2020 was not deducted. Now on 28.10.2020 I am paying the premium for the month if 05.10.2020 manually which is after grace period. Is there any technical problem to pay premium after grace period. Will it create problem for next premiums. Will it be treated as discontinue of premium of policy.

If you have any queries about these to mail these id mentioned below.

Email Id: marketing@comparepolicy.com

pls guide me