Sahara Life Insurance Claim Settlement Ratio 2019-20

Sahara India Life Insurance Co. Ltd. (SILICL) is the first fully-owned Indian private sector life insurance company without any foreign partner with an initial paid-up capital of 157 crores. It is operated by one of India’s largest conglomerates Sahara India Pariwar. Headquartered in Lucknow, Sahara India Pariwar is a renowned business house. SILICL provides a complete range of insurance solutions to its customers. SILICL launched its operation after obtaining a mandatory regulatory nod from the Insurance Regulatory and Development Authority of India (IRDAI) on February 6, 2004.

Table Content

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

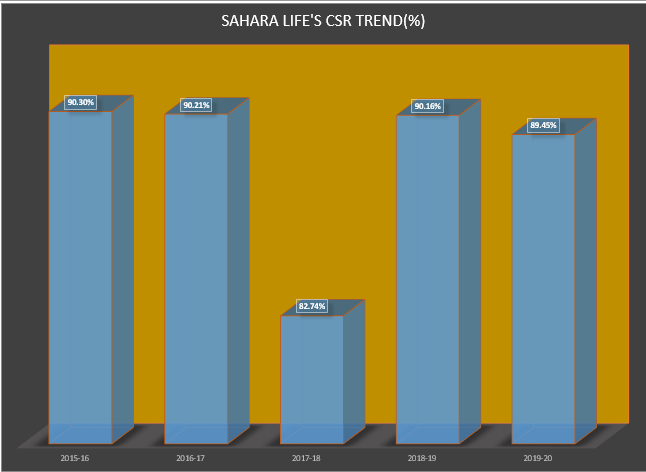

Past 5 years CSR Trends for Sahara Life Insurance Co.

Consistency of the CSR year on year is an ideal way to give preference to the insurance company. Consistency to maintain a higher claim settlement ratio is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the Sahara Life Insurance Co. towards the settlement of death claims.

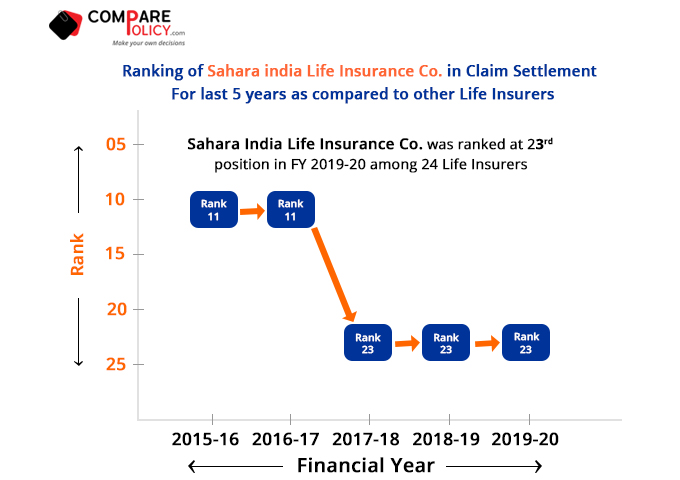

Rank in Claim Settlement among other Life Insurers

Well, the way we spend last year it was quite hard to survive. Wherever we saw the people, they are just hopeless and trying to keep faith in God and medical science. At this time the people who have insurance policy they are leaving without any fear cause an insurance plan can make your death valuable or with the insurance plan, you can make money with your death. After Covid-19 Insurance service become an essential service for people and everyone should insure themselves.

It signifies the position where Sahara Life Insurance Co. lies, in respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. This rank is based on the claim settlement percentage attained by Sahara Life Insurance Co. in the respective financial years.

CSR Details of Sahara Life Insurance Co. for the Financial Year 2016-17

The latest Claim Settlement Ratio for the Financial Year 2019-20 is 89.45%. The CSR report told us a lot of things and give us a proper way to make and take some best decisions in terms of insurance policy or service. Look the way we all spend last year with the fear of Covid-19, it was vulnerable and it was quite a hard time for everyone.

Wherever we used to see, people are in awe and it’s worst, after this, we all know one thing is that insurance service is also an essential service and everyone should be insured. We don’t know about uncertainties but we can make things much better for us with insurance policy.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| Sahara Life | 1.53% | 654 | NA | 90.21% | 89.45% |

- The claim settlement ratio of 89.45% is the indicator of the number of death claims settled by Sahara Life against the total claims 654 reported for the FY 2019-20.

- Rs 5.51 Crores of amount has been paid as the claim amount against 654 claims reported in the FY 2016-17 by Sahara Life Insurance Company.

- The claims have been rejected, resulting in a Claim Repudiation of 1.53% for the FY 2019-20.