Aegon life offers a term plan where you can secure your life and your spouse’s life under one umbrella policy. It provides the life cover in case something happens to you or your spouse or both. An ideal plan for working couples.

Get QuotesIn the event of death of either of the insured (husband or wife) during the policy term, the death benefits are paid top the surviving life insured which is 100% of the sum assured once the claim is accepted.

After the lump sum payment on death, the monthly payment of 1.75% of Sum Assured for a period of 60 months commencing from next monthly policy anniversary is paid under this plan. The surviving life will not have the option to take the discounted value of the Monthly payments. If the surviving life dies during the monthly payout period, then the monthly payment will continue to be paid to the legal heir(s) of the policy holder.

In case of accidental death of either of the insured’s, 50% of sum assured is payable to the surviving life along with the death benefit restricted upt0 100 lacs.

On diagnosis of the listed terminal illness, 25% of the sum assured is paid to the life insured subject to the maximum of 100 lacs and the death benefit will reduce equal to the amount already paid to the insured.

Under this plan, the premium payment is eligible for tax benefits as per Section 80C of the Income Tax Act and the policy proceeds are also entitled to the tax exemptions as per Section 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 65 Years |

| Age at Maturity | - | 75 Years |

| Policy Tenure | 5 Years | 65 Years Minus The Higher Of The Entry Age Of Two Lives |

| Premium Paying Term | Same As Policy Term Years | - |

| Premium Paying Mode | Annually And Monthly | - |

| Sum Assured | 25 Lacs | No Limit (subject To Underwriting) |

| Maturity Benefit | Nil | - |

| Plan Type | Online | - |

This plan offers one rider, which is Aegon Life WoP on CI Joint Life Rider which covers 4 critical illness conditions.

Age: 30 years

Profession: Software Engineer

Family Details: His wife is a Business Analyst and they have a son Amol who is 3 years old.

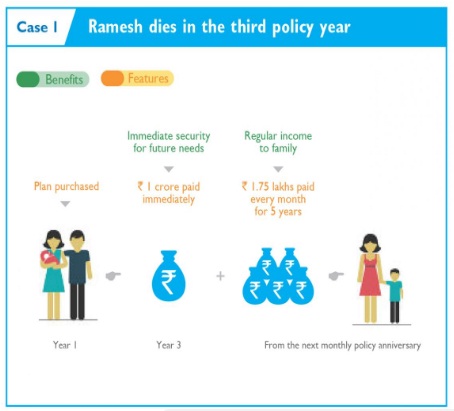

Ramesh opted for Aegon Life iTerm Insurance Plan with Sum Insured of Rs 1 crore (Sum Assured), Policy Term: 30 years, Annual Premium: Rs.26,600/- (exclusive of GST).

Total benefit paid = Rs. 2.05 crores ( Rs. 1 crore paid immediately + Rs. 1.75 lakhs for 60 months)In case of an accidental death of Ramesh, Sheetal will get an additional payout of Rs. 50 Lakhs as lump sum.

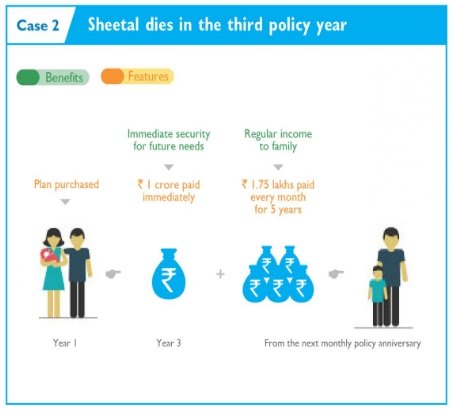

Thus, the total payout = Rs. 2.05 crores ( Rs. 1 crore paid immediately + Rs. 1.75 lakhs for 60 months). In case of an accidental death of Sheetal, Ramesh will get an additional payout of Rs. 50 lakhs as lump sum.

Q: What are the benefits available in Aegon Life iTerm Insurance Plan?

Ans: Under Aegon Life iTerm Insurance Plan, you can avail the death benefit which a nominee will receive in the event of demise of the insured during the policy term. The death benefit can be opted as a lump sum or monthly income.

Q: How Aegon iTerm Plan provides complete financial security for your family?

Ans: Aegon Life iTerm pays an amount to the nominee equal to the sum assured chosen upon commencement of the policy. So, in the event of your demise, it assures a comprehensive financial cover for your family and loved ones.

Q: What all tax benefits are available under Aegon Life iTerm Insurance Plan?

Ans: Aegon Life iTerm Insurance Plan offers tax benefits as per section 80C of the Income Tax Act. The policy proceeds can also avail the tax exemptions as per section 10 (10D) of the Income Tax Act, 1961.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing